DEBT

Madison sponsors institutionally-backed debt investment vehicles which have closed in excess of $25 billion of debt transactions.*

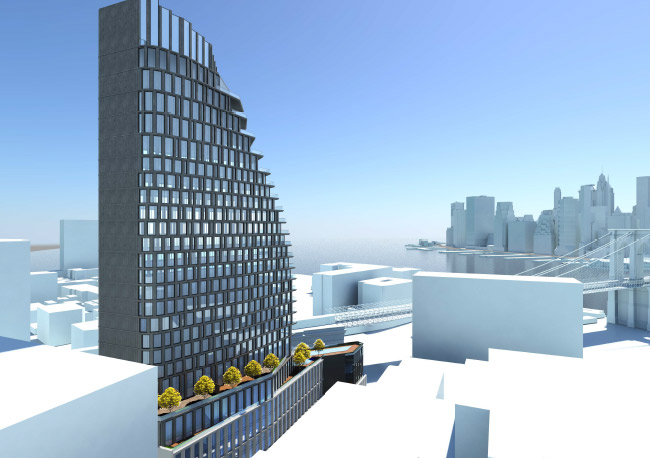

219-235 East 42nd Street

- LOCATION: Manhattan, ny

- LOAN SIZE: $720.0 MM

- LOAN TYPE: CONSTRUCTION

- PROPERTY TYPE: multifamily

Ridge Road

- LOCATION: Charlotte, NC

- LOAN SIZE: $47.0 MM

- LOAN TYPE: Construction

- PROPERTY TYPE: Build-to-Rent Townhomes

*Figures presented herein represent debt transactions of investment vehicles sponsored by Madison Realty Capital and excludes transactions executed by certain controlled affiliates.